Investment risk can be measured in different ways. In this article, we’ll take a look at two popular risk metrics: volatility and maximum drawdown. These statistics (and a lot more) are calculated on our TSP funds page, and updated every business day.

One popular risk metric is volatility. Technically speaking, this refers to the standard deviation of the annual returns. Basically, you calculate an average value of the returns, and then look at how much any given return measurement differs from that average. An investment that has very steady returns, like the G Fund, has very low standard deviation or volatility. The G Fund is in fact guaranteed not to lose any money, and its standard deviation (zero percent) is by far the lowest of all funds. On the opposite side of the volatility spectrum, the S Fund (small cap U.S. stocks) has the largest annualized standard deviation: 21.44% as of this writing, and is therefore the riskiest. The I Fund (international stocks) is a close second, with a standard deviation of 19.63%, and coming in third is the C Fund (U.S. large cap stocks) at 18.35%. You can also see this by inspecting a historical chart of these funds: lots of ups and downs. Compare this to the F Fund (U.S. bonds) which has a relatively smooth return curve, and a standard deviation of 4.04%.

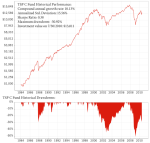

The second risk metric we’ll look at is maximum drawdown. This is the largest historical peak-to-trough decline in the TSP fund value, measured as a percentage between the peak and the trough. Another way to look at this is to visualize an investor who had the misfortune of buying the fund at its previous peak value, and then holding it all the way through to its worst decline. By this measure, the I Fund is the riskiest, with a maximum drawdown of -60.89%, which occurred during the 2008-2009 global financial crisis. (An investor who’d bought the fund at its peak in 2007 would have experienced a 60.89% loss by March 2009). Compare this to the G Fund (zero drawdown) or the F Fund: -5.15% maximum drawdown.

You can use the same risk metrics when evaluating an investment strategy. So for example, the TSP Folio strategy as of this writing has an annualized standard deviation of 6.5%, and a maximum drawdown of -10.2%.