Relying on bond funds for steady returns has worked out well, until recently. U.S. bond investors have enjoyed a long bull market that started in the early 1980s, when interest rates were as high as 17 percent. Interest rates and bond prices move in opposite directions. As rates fell from their 1980s peak, bond prices rose, and investors enjoyed capital gains on top of high interest rates. Today we...

[more]

Those of us who were investing during the dot.com bubble probably remember Federal Reserve Board Chairman, Alan Greenspan’s “irrational exuberance” speech in December 1996: Lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know...

[more]

The Thrift Savings Plan (TSP) for Federal civilian employees and members of the uniformed services is considered one of the finest retirement savings plans in the United States. The TSP has long given you the ability to make your own investment decisions, as each participant is unique and individual. But until now it did not offer the flexibility and tax treatment of a Roth option. Currently, your TSP...

[more]

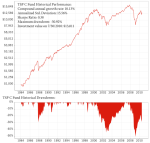

If you’ve been investing in the Thrift Savings Plan for more than just a few years, I’m sure that you remember what happened to the TSP stock funds during 2008 and early 2009. The C Fund, which tracks large cap U.S. stocks, lost over 55 percent of its peak value. The S Fund (invested in small cap stocks) and I Fund (which tracks international equities) suffered even larger drawdowns. It was...

[more]

Now that you have a good understanding of the available TSP investment options and historical risks and returns of the various TSP funds, you may be wondering how to actually invest in the Thrift Savings Plan. What's a good investment strategy? How do you decide which funds to allocate your savings to, and how much? Broadly speaking, there are two different approaches to answer these questions. You...

[more]

Investors in the Thrift Savings Plan can choose from any of the available 10 funds we describe and track on our TSP Funds page, but rather than getting into the nitty gritty details about each fund, this post presents a high level overview of what you’re investing in when you choose any of these funds. It answers the question: What are my investment options in the Thrift Savings Plan? At the highest level, the Thrift Savings Plan gives you the option to invest in two asset classes:...

[more]

Investment risk can be measured in different ways. In this article, we’ll take a look at two popular risk metrics: volatility and maximum drawdown. These statistics (and a lot more) are calculated on our TSP funds page, and updated every business day. One popular risk metric is volatility. Technically speaking, this refers to the standard deviation of the annual returns. Basically, you calculate an average value of the returns, and then look at how much any given return measurement...

[more]

When we set out to create the TSP Folio strategy, we first analyzed the individual TSP investment funds: Asset Class TSP Fund Description U.S. Stocks C Fund Common Stock Index Investment Fund S Fund Small Cap Stock Index Investment Fund International Stocks I Fund...

[more]

The Simple Moving Average (SMA) is a popular trend-following indicator. When graphed on a chart, it filters out the day-to-day noise in security prices, revealing the longer-term trend. The following chart shows the TSP C Fund along with its 10-month SMA: Investors can use the SMA as a signal to time the buying and selling of a security. In an upward trend, the investor buys the security when its...

[more]

Momentum is the tendency of recent price changes in an investment or asset class to persist for some period of time into the future. The evidence for momentum is pervasive, supported by academic and practitioner research and more than 300 published papers over the past decades. We won't attempt to summarize the momentum literature, but encourage investors to learn more about it, starting with the ...

[more]

The majority of popular investment advice follows a predictable recipe: adopt a diversified portfolio of low-cost index funds and determine your asset allocations. Buy and hold the funds, and regularly add to your savings. Rebalance your portfolio at the end of each year, and repeat until you're 65. Retire happily. This advice is often accompanied by long-term charts that show the impressive returns of stocks, bonds, and other asset classes over the past decades. Looks great, right? But...

[more]

Try TSP Folio

Sign up for a free TSP Folio trial!