Relying on bond funds for steady returns has worked out well, until recently. U.S. bond investors have enjoyed a long bull market that started in the early 1980s, when interest rates were as high as 17 percent. Interest rates and bond prices move in opposite directions. As rates fell from their 1980s peak, bond prices rose, and investors enjoyed capital gains on top of high interest rates. Today we find ourselves at the other end of the spectrum: interest rates are near multi-decade lows, due partly to unprecedented intervention by the Federal Reserve (Quantitative Easing and other measures). Money market funds earn close to zero percent. Even 10-year Treasury bonds reached a low point of 1.4% last year, and had a yield of 1.6% just last month.

The trend of declining interest rates is reflected in the performance of the TSP G Fund: when it was introduced in the late 1980s, it returned as much as 8.9 percent per year, risk free. Over the past twelve months, it has returned only 1.42 percent. The average U.S. inflation rate is around 3% per year, so at this rate, the G Fund is not even maintaining your purchasing power.

Bond Party Over? Photo credit: shawncampbell

Bond Party Over? Photo credit: shawncampbell

The “bond party” that started in the 1980s appears to be over for now. The yield on 10-year Treasurys has risen to 2.2 percent — a 37% jump since the beginning of May. Investors in the F Fund have noticed this sudden change: the fund is down 2.5% since May. No one can predict where rates will go from here, but this is a good time to ask yourself some questions: Since interest rates are still near multi-decade lows, how much “upside” is left in the TSP F Fund today? At these levels, what are the odds of significant capital appreciation versus losses?

But isn’t the F Fund a safe fund?

From the tsp.gov website you can learn that the F Fund has so far compounded at 7.0 percent per year since first becoming available in January 1988. And it has done so with a tolerable maximum drawdown of -6.6 percent. If you stop your research there, you’d conclude that the F Fund must be a steady, safe source of returns.[1] But you’d be wrong. Look back further to the beginning of the 20th century, and a completely different picture emerges.

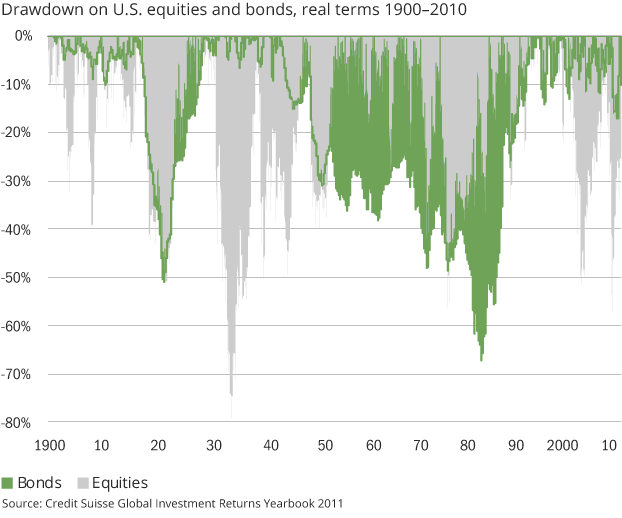

From 1900 to 1980, U.S. government bonds provided an annualized real return of only 0.2 percent. You read that right: 0.2% per year for 80 years.[2] Looking at interest rates during this period, they rose from Great Depression lows towards their peak in the 1980s. And as far as bonds being “lower risk”, take a look at this chart:

The current environment — interest rates near multi-decade lows — is more like the 1940s, and less like the early 1980s. Armed with our longer-term insights into the bond market, it should not come as a surprise that interest rates will eventually rise, and the TSP F Fund will struggle. Low starting bond yields today are a predictor of low returns later.[3]

If interest rates rise, how much can the F Fund lose?

The longer a bond’s duration, the greater the volatility and potential losses when interest rates change. The F Fund holds thousands of bonds of various durations. The formula for calculating duration is complicated, but bond fund managers publish an “effective duration,” which indicates how sensitive the fund is to changes in interest rates. As of December 2012, the F Fund had an average duration of 4.6 years. For a more current number, we can look at the iShares Total U.S. Bond Market ETF (AGG), which tracks the same index as the F Fund. Its effective duration is 5.0 as of this writing. What this means is that for every 1 percent rise in interest rates, we can expect the F Fund to lose 5 percent of its value. Remember that rates were 17 percent in the early 1980s, and are currently around 2 percent for medium-duration bonds. That’s a 15 percent spread — I’ll leave it to you to do the math, based on your own opinion about future interest rates. Even if you’re not convinced that rates will rise anytime soon, you may want to consider your options in terms of risk-to-reward (i.e., what’s the potential upside versus the potential downside).[4]

To G, or not to G? That is the question…

It’s therefore no surprise that seasoned investors are very concerned about the current bond market and the outlook for the foreseeable future. As John Bogle, founder of Vanguard and inventor of the first index fund put it recently: “the outlook for bonds over the next decade is really terrible.”[5] Mr. Bogle adds that investors can’t just hold stocks, and should diversify:

But diversify into what? They need alternatives, bonds, for the most part. What’s so frightening right now is that the alternatives to equities are so poor.

Enter the TSP G Fund. Sure, its returns over the past year have been an anemic 1.4 percent. But payment of G Fund principal and interest is guaranteed by the U.S. government. Which is an extremely unusual and valuable feature that many will hopefully learn to appreciate in the decades ahead of us. Also, when interest rates rise, the G Fund rate will rise right along with them — again, without the loss of principal that you would experience in the F Fund under the same circumstances. From this perspective, as far as bond funds go, the G Fund is still a better deal than just about anything else out there.

Conclusion

So, what’s a TSP bond investor to do? Well, if you believe that interest rates are indeed on the rise, you’re better off holding the G Fund than the F Fund, as explained before. If you’re not certain about what interest rates will do, then perhaps a tactical asset allocation makes sense. For example, our tactical investment strategy measures the recent returns of the G and F Funds, and uses their relative strength to determine which one (and how much) to use for the bonds allocation.[6]

Notes

- I can empathize with this, because I experienced something similar with stocks during the 1990s. When I first started investing, it seemed like stocks could only go in one direction: up. The technology stocks crash in 2000-2001 was a rude awakening! Since then, I’ve appreciated the insights gained from studying much longer asset class histories.

- Credit Suisse Global Investment Returns Yearbook (GIRY) 2011, page 5. With “real” returns, we mean “inflation-adjusted.”

- I’m not suggesting that things will get this bad for the F Fund. Based on current holdings, the F Fund has an effective duration of approximately 5.0 years. Compare this to a longer-duration bond fund such as the iShares 20+ Year Treasury Bond ETF (TLT), which has a duration of 16.8. The bonds in the GIRY study were on the longer end of the duration spectrum. See next paragraph for specific impact of duration on fund drawdowns.

- The relationship between effective duration and volatility is also straightforward: A fund with duration of 10 years is expected to be twice as volatile as a fund with a 5-year duration.

- Other experienced bond market experts have also turned bearish. For example, see the latest commentary from Bill Gross, Founder and Co-Chief Investment Officer of PIMCO, a pre-eminent bond management firm: There Will Be Haircuts.

- For example, between January 1999 and January 2001, interest rates rose from 4.3% to 6.1%. During 1999, the F Fund struggled to break even in this rising interest rate environment. By contrast, the G Fund did fine. The TSP Folio strategy backtest picked up on this weakness, favoring the stronger G fund over the F Fund during much of this period.